The Approval Process

As we went through the approval process, I discovered a book that was extremely helpful to me. The book, called “Rich Dad, Poor Dad,” is written by Robert T. Kiyosaki. (Amazon, $7.34) This book is about the way wealthy people look at money and investments as opposed to the way others view their money.

If you are someone who has always worked a job and collected a paycheck, becoming a sandwich shop franchisee and starting a business can be stressful for you. Quitting my job of seventeen years, with its reliable paycheck, to work for myself was one of the most difficult things I have ever done. If you have only ever dealt with household budgets and expenses, you will find that taking care of business finances is quite different. You will need to change the way you think about money, and the book I mentioned above helped me to do that.

So now that we have decided on a franchise to purchase, we had to meet with the franchisors’ representative to get approved. During this meeting, as part of the early approval process, we received the “Franchise Disclosure Document.” The FTC requires this, and it spells out what the business relationship will be between you as a franchisee and the franchisor. This document is important. Read it carefully and review it with your attorney. It is important that you know exactly what you are getting into because you will be signing a franchise agreement contract that will not expire for years, and there will be penalties for breaking the agreement. There will be a cooling off period between the time you sign the FDD and when you sign the actual franchise agreement.

Required Documentation

Our franchisor required quite a bit of documentation from us to become franchisees. First, we had to provide a personal financial statement detailing our net worth. We had to submit a credit report so that they could be certain we could obtain financing. We also had to provide a business plan, an organizational chart of how our company would be structured, and a break-even analysis. They also provided a list of current franchisees that they suggested we contact to learn more about the franchise.

The franchisors’ representative provided us with a list of current franchisees who were willing to share their information with us. The franchisor cannot make representations to you regarding what your sales will be. It is important to talk to least two or three existing franchisees. If they are willing, meet with them at their franchise location.

We met with three or four franchisees at their locations. We were able to look around at everything and get a feel for what it was like. You need to ask about things like:

- Average Weekly Sales

- Rent Cost

- Utility Cost

- Food Cost

- Labor Cost

- Number of Employees

- Employee starting wages

- Credit Card fees

- Additional fees from the franchisor other than royalties.

They may not be willing to share all this information but listen carefully to what they will tell you and take notes. You will need this information when you go to do your business plan and break-even analysis.

Personal Financial Statement

The personal financial statement and the credit report were easy. I found an Excel template for the financial statement online and I used that. I made it as detailed as possible because I knew I would need it again when we went to obtain financing. As far as the credit report is concerned, we just had to fill out a form authorizing them to check our credit if I remember correctly. Back then, you could not just go online and get it. We had excellent credit so that was not a problem.

Business Plan

The franchisor provided me with a simple business plan template where all I had to do was fill in the blanks. I took all the figures I received from the franchisees and averaged them together. This gave me an estimation of our business costs. A business plan can be as simple or as elaborate as you wish. If you create a detailed plan, it could be much easier for you to obtain financing. There are many books on the subject if you are not sure how to go about creating one. Since the franchisor was happy with it, I just used their simple template to save time.

Organizational Chart

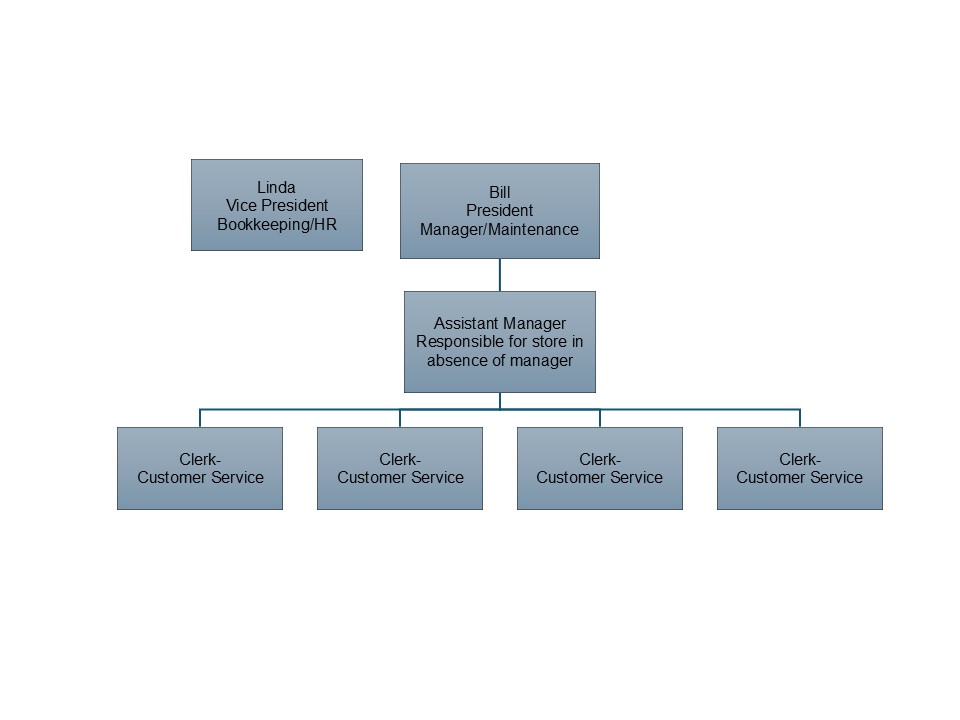

Next, the organizational chart. We had to decide the structure of the business and create a detailed job description for each position. At the time, we thought that Bill, my husband, could manage the store and do the store maintenance. And I could keep my job and do the books for the company. So, he was on the top of the org chart as “President/Manager” and I was on the same level as him as “Vice President/Bookkeeper”. Below is a picture of that first organizational chart. Believe me, it has gone through many revisions over the years.

Break Even Analysis

Last was the break-even analysis, which took the most time. I’m not going to go into all the details of how to create one here; there are many templates for creating one on the internet. Basically, it’s a spreadsheet that lists all the costs, both variable and fixed, and calculates the sales goal you will need to reach to break even. I set up my own Excel spreadsheet so that I could easily play with the numbers to create different scenarios. Once I created one that I was confident about, I submitted it to the franchisor. I suppose you could pay an accountant to create this for you, but we were on a tight budget, and I wanted to understand everything I could about it myself.

We submitted what they asked for, they reviewed it, then we had to do one final interview where they questioned us about the submitted reports and checked our understanding of everything. They were happy with things and so we were approved to become franchisees!

Key Insights

Prepare yourself to do quite a bit of research and planning, especially if you are like I used to be and are not familiar with business operations. This is where having a business degree would have helped me tremendously. And one thing to remember, as the owner you get paid last!

Up Next

Deciding on a corporate structure, deciding on a company name, and forming a company.

Subscribe to our newsletter!

Leave a Reply